5 Hidden Problems of Buying Property in Dubai That No Agent Will Tell You

Buying property in Dubai—especially for foreign investors—can offer tremendous opportunities. However, behind the shimmering glass towers and luxury projects lie hidden challenges that many real estate agents simply don’t mention. In this article, we reveal 5 key risks you should be aware of before making a purchase to avoid costly mistakes.

1. Freehold or Leasehold? Know the Difference!

In Dubai, there are two main types of property ownership:

-

Freehold: Full ownership of the property and the land.

-

Leasehold: Long-term lease rights, usually for 99 years.

Many buyers assume they own the property outright, while in reality, they only hold the right to use it for a fixed term.

💡 Tip: Always check the title deed for the ownership type. If it’s leasehold, ask about limitations and conditions before signing.

2. Hidden Costs After Purchase

Agents usually highlight the property price but often downplay or omit additional expenses such as:

-

Annual service charges

-

VAT (for certain projects)

-

Registration fees

-

Ownership transfer fees

These hidden costs can add up to 6%–8% of the total property price.

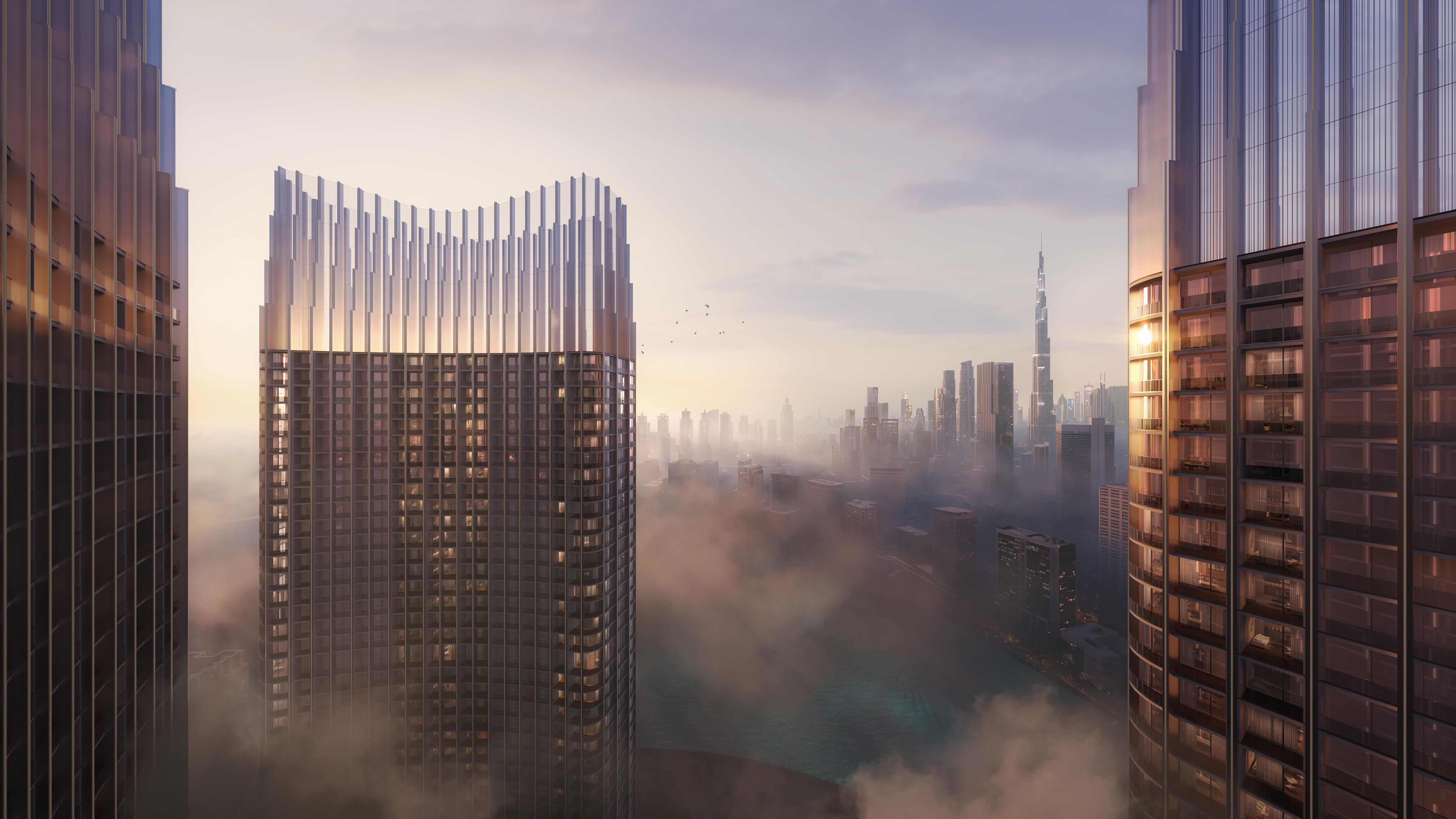

3. Incomplete Projects & Delayed Handover

Over the past years, several real estate developments in Dubai have been delayed or left incomplete.

💡 Tip: Always research the developer’s track record and ask for the latest project progress. Prefer projects that are at least 70% completed for more security.

4. Difficulty Reselling Certain Properties

While Dubai’s real estate market is dynamic, reselling properties—especially newly launched or overpriced ones—can be challenging.

💡 Tip: Before buying, ask about the resale potential and check recent market activity in the same area or project.

5. Misleading Location Descriptions

Terms like “5 minutes from Burj Khalifa” or “sea view” are commonly used in marketing, but the reality can be very different. Sometimes, the “view” is only available from premium units, or the location is much farther from the city center than implied.

💡 Tip: Always check the exact location on a map, and if possible, request a physical or video tour of the property.

Property Price Comparison in Key Dubai Areas (2025)

| Area | Unit Type | Price (AED) | Approx. Price (IRR) |

|---|---|---|---|

| Downtown Dubai | Studio | 490,000 | 10.29 billion IRR |

| Downtown Dubai | 1 Bedroom | 1,475,000 | 30.97 billion IRR |

| Downtown Dubai | 2 Bedrooms | 2,450,000 | 51.45 billion IRR |

| Palm Jumeirah | Studio | 1,170,000 | 24.57 billion IRR |

| Palm Jumeirah | 1 Bedroom | 2,240,000 | 47.04 billion IRR |

| Palm Jumeirah | 2 Bedrooms | 2,700,000 | 56.70 billion IRR |

💱 Conversion based on an estimated exchange rate of 21,000 IRR per AED

✅ Conclusion

Buying property in Dubai can be highly profitable, but being aware of the hidden challenges is essential. By understanding the ownership type, accounting for hidden fees, checking project completion, assessing resale prospects, and verifying locations, you can make smarter, safer, and more profitable investment decisions.