Dubai's real estate market continues to thrive in 2025, with record-breaking transactions and unprecedented investor confidence. Whether you're a foreign investor or UAE resident, purchasing property in Dubai can be completed efficiently within 30 days when you follow the right process. This comprehensive guide provides a step-by-step checklist to ensure your property purchase goes smoothly and successfully.

Why Invest in Dubai Real Estate in 2025?

Can a Foreigner Buy a House in Dubai? Yes, absolutely. Foreign nationals are permitted to purchase property in designated "freehold" zones in Dubai. These areas give you complete ownership of the property and the land it sits on. You do not need to be a resident of the UAE to buy property; in fact, a significant real estate investment can be your pathway to securing a long-term residence permit, like the coveted Golden Visa, for investments of AED 2 million (approximately $545,000 USD) or more.

Dubai's property market has reached new heights with over 31,920 transactions worth AED 147 billion recorded in the last quarter of 2024. The market offers unique advantages including no property taxes for residential properties, 100% foreign ownership in designated freehold areas, and attractive visa pathways for property investors.

Key Market Highlights:

- Property values rising by an average of 18% in 2025

- New visa reforms allowing 100% foreign ownership

- Expanded freehold zones across Dubai, Abu Dhabi, and Sharjah

- Streamlined digital processes reducing paperwork and transfer times

📋 Your 30-Day Property Purchase Checklist for Dubai (2025)

This timeline is ambitious but achievable for a cash buyer or a buyer with mortgage pre-approval.

Week 1: Preparation and Planning

Day 1-3: Define Your Budget & Financials

The first step is to establish a clear budget. This goes beyond the property's ticket price. A crucial update for 2025 is that buyers should prepare for higher upfront costs. Many banks no longer roll the 4% Dubai Land Department (DLD) fee and 2% agent commission into the mortgage loan. This means you need to have these funds available in cash.

💡 INTERACTIVE COST CALCULATOR:

For a AED 2,000,000 property, your total costs breakdown:

🏠 Purchase Price: AED 2,000,000

📝 DLD Transfer Fee (4%): AED 80,000

🤝 Agency Commission (2%): AED 40,000

📋 Admin and Trustee Fees: AED 5,000

🏦 Mortgage Fees (if applicable): AED 15,000-25,000

💼 Legal Fees: AED 8,000-12,000

🔍 Property Inspection: AED 2,000-5,000

💱 Currency Exchange: AED 5,000-15,000

───────────────────────────────────────

💰 TOTAL UPFRONT COST: ~AED 635,000-662,000

Additional costs breakdown by property value:

| Property Value | DLD Fee (4%) | Agency (2%) | Total Additional Costs |

|---|---|---|---|

| AED 1,000,000 | AED 40,000 | AED 20,000 | ~AED 70,000 |

| AED 1,500,000 | AED 60,000 | AED 30,000 | ~AED 100,000 |

| AED 2,500,000 | AED 100,000 | AED 50,000 | ~AED 165,000 |

| AED 5,000,000 | AED 200,000 | AED 100,000 | ~AED 320,000 |

Day 4: Mortgage Pre-Approval (if required)

If you need financing, obtain mortgage pre-approval early in the process. UAE banks typically require:

- Minimum monthly income of AED 15,000 (~$4,000)

- Down payment: Minimum 25% for foreigners

- Stable employment history

- Clear credit record

Documents for Mortgage Application:

- Original passport and visa

- Emirates ID (if resident)

- Salary certificates

- 6-12 months of bank statements

- No Objection Certificate from current employer

Week 2: The Property Search

Day 8-10: Find a RERA-Certified Agent & Define Your Needs

Partner with a real estate agent registered with the Real Estate Regulatory Agency (RERA). A good agent provides invaluable market knowledge, handles negotiations, and manages the complex paperwork.

🏆 TOP-RATED REAL ESTATE AGENCIES (2025):

-

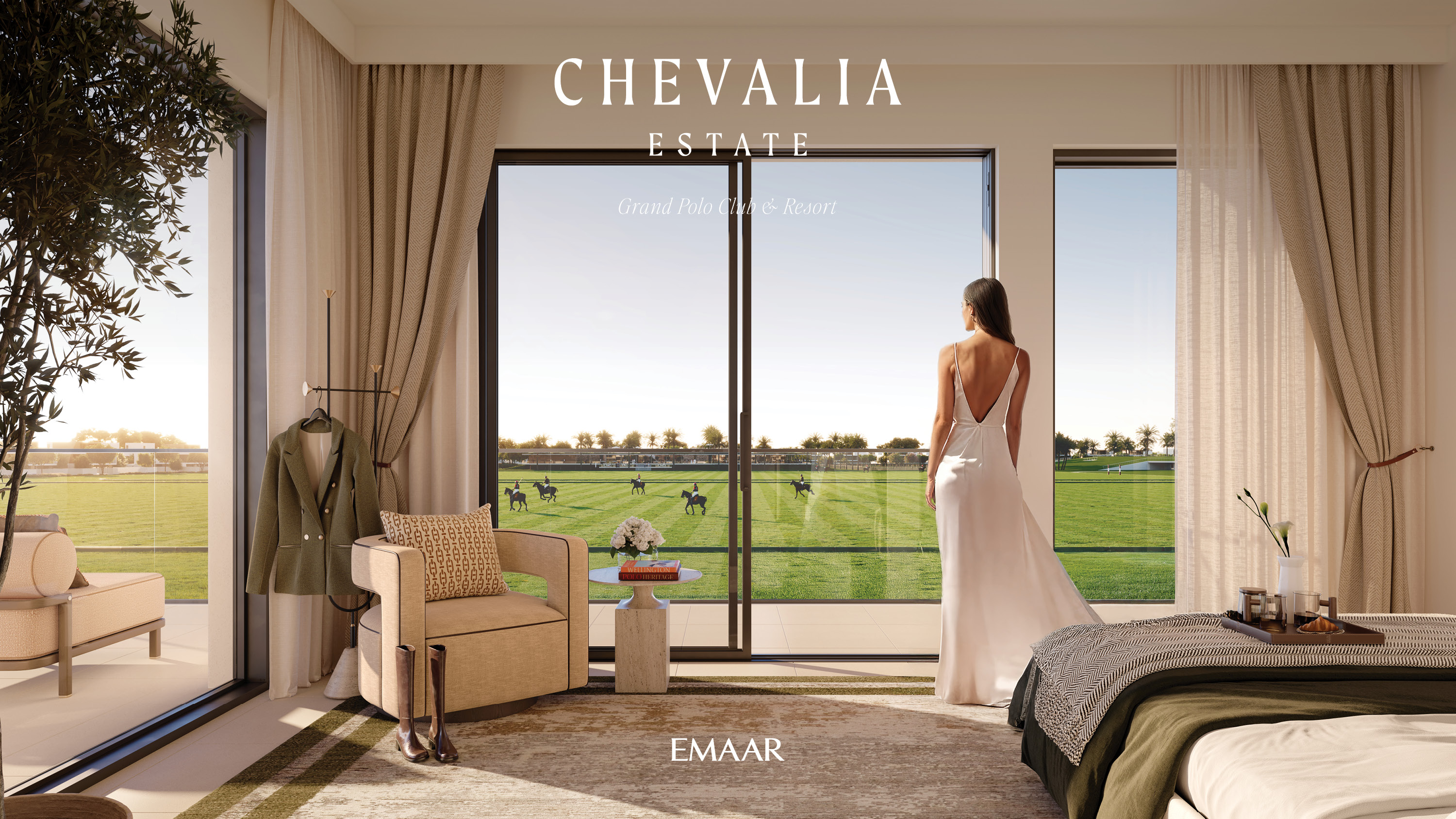

Emaar Properties - ⭐⭐⭐⭐⭐ (4.8/5)

- Specializes in: New developments, off-plan

- Contact: +971-4-367-3333

-

Better Homes - ⭐⭐⭐⭐⭐ (4.7/5)

- Specializes in: Resale properties, luxury homes

- Contact: +971-4-368-6868

-

Allsopp & Allsopp - ⭐⭐⭐⭐⭐ (4.6/5)

- Specializes in: Premium properties, international clients

- Contact: +971-4-429-4444

-

Metropolitan Premium Properties - ⭐⭐⭐⭐ (4.5/5)

- Specializes in: Investment properties, rental management

- Contact: +971-4-453-9999

Day 11-14: View Properties & Make an Offer

With your agent, begin viewing shortlisted properties. Once you find the perfect home, it's time to make an offer.

💡 PROPERTY VIEWING CHECKLIST:

✅ Structural integrity and finishing quality

✅ Electrical and plumbing systems

✅ Air conditioning and ventilation

✅ Windows, doors, and security features

✅ Community amenities and maintenance

✅ Service charges and utility connections

✅ Parking allocation and accessibility

✅ Building management and security

✅ Internet connectivity and utilities setup

✅ Nearby amenities (schools, hospitals, shopping)

Week 3: Securing the Deal

Day 15-18: Sign the Agreement & Pay the Deposit

Once the seller accepts your offer, you will sign the Memorandum of Understanding (MOU), also known as Form F from the DLD.

📄 KEY DOCUMENTS REQUIRED:

- Form F (MOU): Official sale agreement

- Deposit: Typically 10% of purchase price

- Passport copies: All parties

- Emirates ID: If applicable

- Power of Attorney: If using representative

Day 19-21: The Developer's No Objection Certificate (NOC)

The NOC confirms that there are no outstanding service charges or disputes related to the property.

💰 NOC FEES BY DEVELOPER:

| Developer | NOC Fee Range | Processing Time |

|---|---|---|

| Emaar | AED 2,000-5,000 | 3-5 days |

| DAMAC | AED 1,500-4,000 | 2-4 days |

| Dubai Properties | AED 1,000-3,000 | 2-3 days |

| Nakheel | AED 2,500-6,000 | 4-7 days |

| Meraas | AED 1,500-4,500 | 3-5 days |

Week 4: The Final Transfer

Day 22-25: Finalizing Finances

🏦 RECOMMENDED CURRENCY EXCHANGE SERVICES:

- Wise (formerly TransferWise) - Lowest fees, best rates

- UAE Exchange - Local presence, reliable service

- Al Ansari Exchange - Competitive rates, fast transfers

- Western Union Business - Global coverage, secure transfers

Day 26-30: Ownership Transfer at the DLD

The final step is meeting the seller at a DLD-approved Trustee Office to complete the ownership transfer.

📍 DLD TRUSTEE OFFICES LOCATIONS:

- DLD Main Building: Al Karama, Dubai

- Emirates NBD: Multiple branches

- ADCB: Multiple branches

- Mashreq Bank: Multiple branches

- CBD: Multiple branches

🎯 CASE STUDIES: SUCCESSFUL PROPERTY PURCHASES

Case Study 1: British Investor in Dubai Marina

- Property: 2-bedroom apartment, Dubai Marina

- Purchase Price: AED 1.8 million

- Timeline: 28 days (cash purchase)

- ROI: 6.5% rental yield

- Total Investment: AED 1.95 million (including fees)

Case Study 2: German Family in Arabian Ranches

- Property: 4-bedroom villa, Arabian Ranches

- Purchase Price: AED 4.2 million

- Timeline: 35 days (with mortgage)

- Down Payment: AED 1.05 million (25%)

- Monthly Mortgage: AED 15,800

Case Study 3: Indian Professional in JVC

- Property: 1-bedroom apartment, JVC

- Purchase Price: AED 850,000

- Timeline: 22 days (cash purchase)

- ROI: 7.8% rental yield

- Golden Visa: Qualified for 2-year visa

Pre-Purchase Property Inspection Checklist:

- ✅ Structural integrity and finishing quality

- ✅ Electrical and plumbing systems

- ✅ Air conditioning and ventilation

- ✅ Windows, doors, and security features

- ✅ Community amenities and maintenance

- ✅ Service charges and utility connections

Conditions for Buying a House in Dubai

Eligibility Requirements:

For Foreign Buyers:

- No minimum residency requirement

- Purchase allowed in designated freehold areas only

- Valid passport required

- Proof of funds necessary

Property Types Available:

- Freehold: Complete ownership rights

- Leasehold: Long-term lease (up to 99 years)

- Commonhold: Apartment-style ownership with shared facilities

Visa Benefits for Property Investors:

Golden Visa (10 years):

- Property investment of AED 2,000,000+

- Includes family members

- No sponsor required

- Multiple entry privileges

Residence Visa (2 years):

- Property investment of AED 750,000+

- Renewable upon property retention

- Path to permanent residency

How to Buy a House in Dubai as a Foreigner

Legal Framework for Foreign Ownership:

Dubai's 2002 Freehold Law allows foreigners to:

- Buy, sell, and rent property in designated areas

- Own property indefinitely

- Pass property to heirs

- Obtain residence visas through property investment

Designated Freehold Areas:

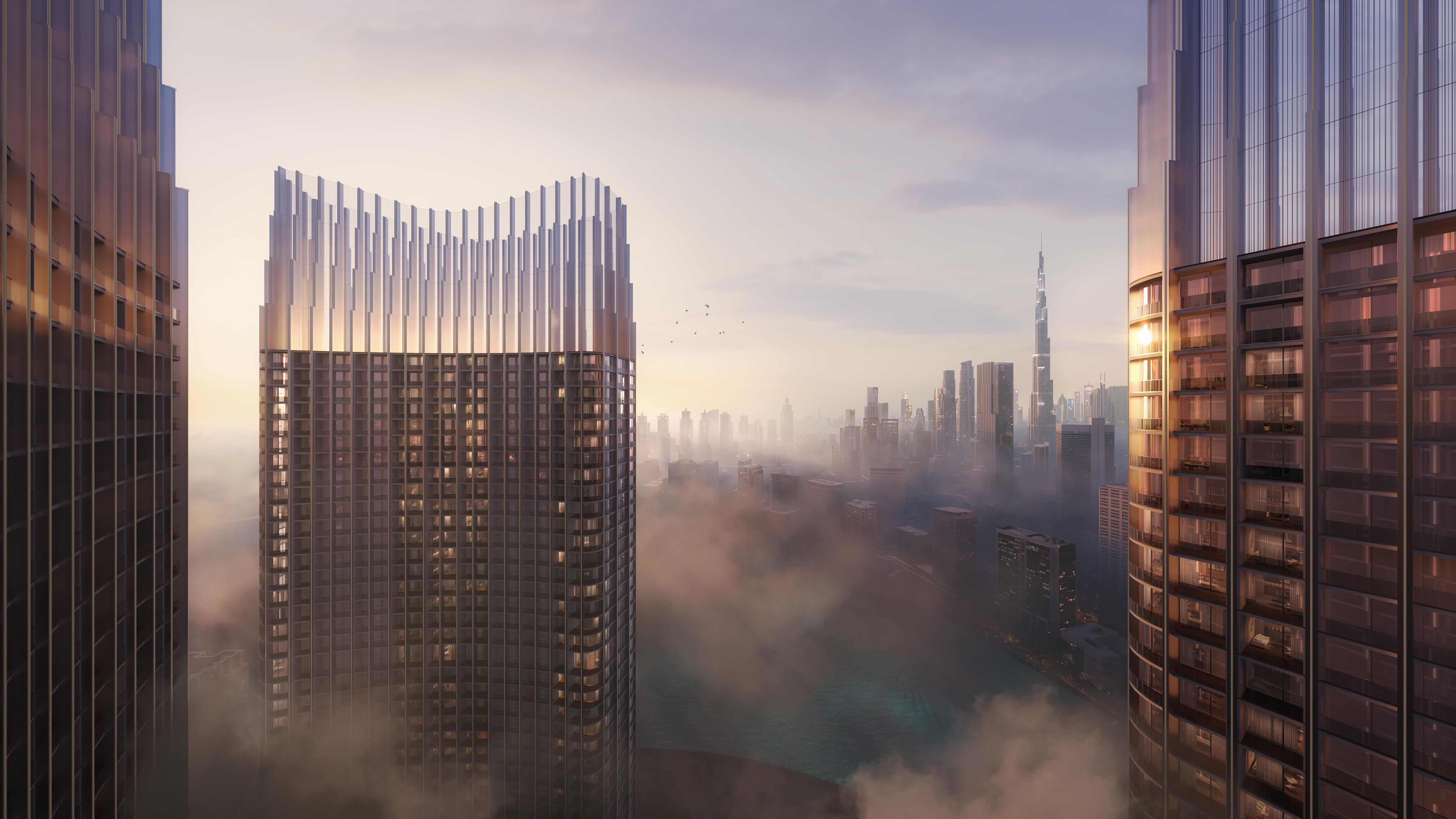

- Downtown Dubai

- Dubai Marina

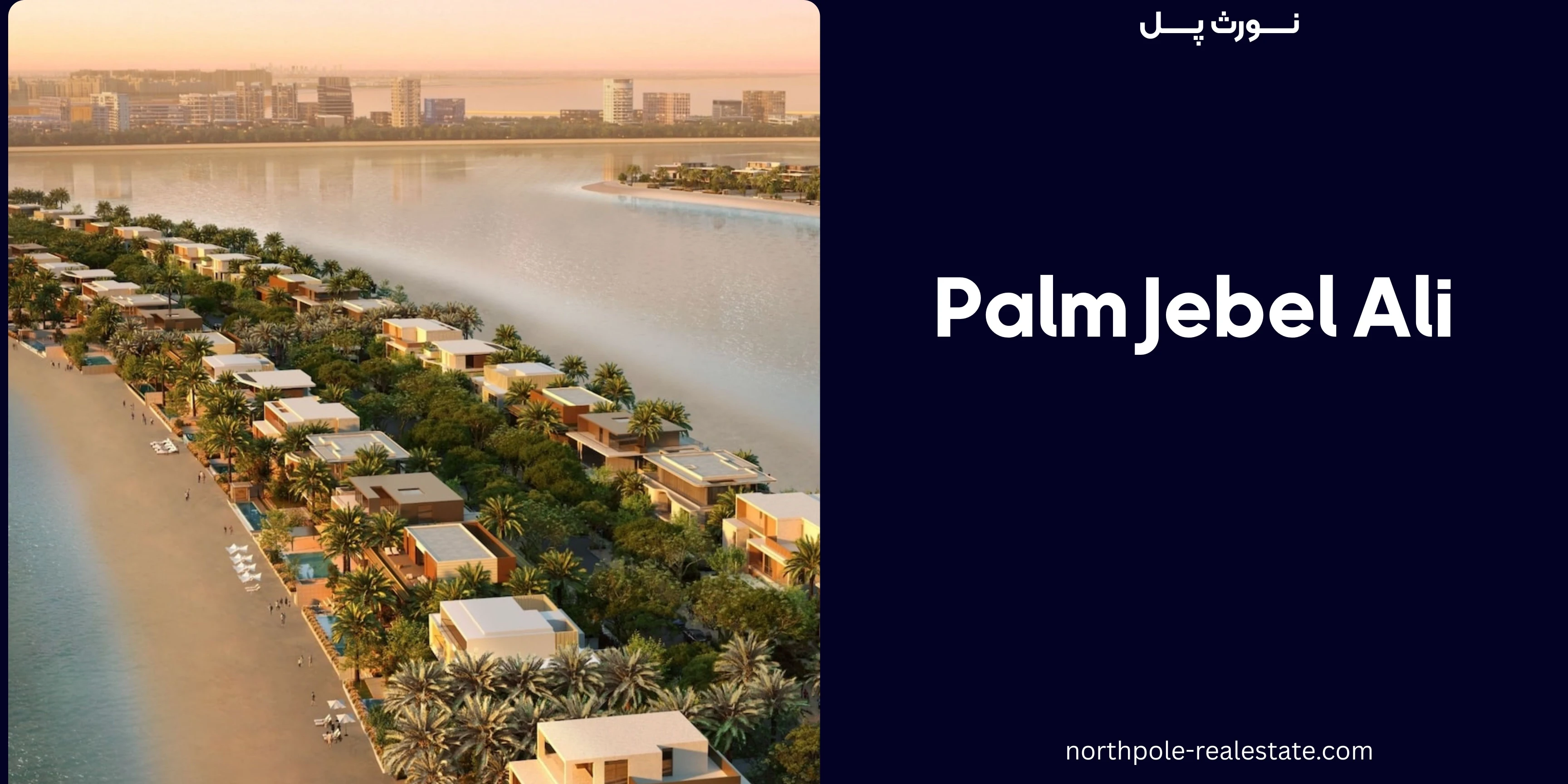

- Palm Jumeirah

- Dubai Hills Estate

- Jumeirah Lake Towers

- Business Bay

- Dubai Silicon Oasis

- Arabian Ranches

- The Greens and Greens 2

TOP 10 DUBAI COMMUNITIES FOR FOREIGN INVESTORS (2025)

Prime Investment Areas with ROI Analysis:

| Community | Avg Price/sq ft | Rental Yield | Investment Grade | Best For |

|---|---|---|---|---|

| Downtown Dubai | AED 3,168 | 5.8% | A+ | Luxury Investment |

| Dubai Marina | AED 1,757 | 6.24% | A+ | High Rental Returns |

| Palm Jumeirah | AED 2,200 | 5.5% | A+ | Premium Properties |

| Jumeirah Village Circle | AED 980 | 7.5% | A | First-time Buyers |

| Dubai Hills Estate | AED 1,650 | 6.8% | A | Family Properties |

| Business Bay | AED 1,400 | 6.5% | A | Business Investment |

| Jumeirah Lake Towers | AED 1,200 | 7.1% | B+ | Affordable Options |

| The Greens | AED 1,350 | 6.9% | B+ | Established Community |

| Dubai Silicon Oasis | AED 950 | 7.2% | B+ | Tech Hub Investment |

| Arabian Ranches | AED 1,800 | 5.9% | A | Villa Communities |

Source: Dubai Land Department, Property Finder, Reidin.com (2025 Data)

📊 DUBAI VS GLOBAL MARKETS COMPARISON (2025)

| Metric | Dubai | London | New York | Singapore |

|---|---|---|---|---|

| Avg Rental Yield | 6.9% | 3.5% | 4.2% | 2.8% |

| Property Tax | 0% | 0.5-3.5% | 1-3% | 0% |

| Capital Gains Tax | 0% | 28% | 25% | 0% |

| Foreign Ownership | 100% | 100% | 100% | 99-year lease |

| Residency Path | Yes | No | No | Yes |

⚠️ COMMON MISTAKES TO AVOID (2025 UPDATE)

Financial Mistakes:

❌ Insufficient Budget Planning: Not accounting for all fees

❌ Currency Timing: Poor exchange rate timing

❌ Hidden Costs: Missing service charges and utilities setup

Legal Mistakes:

❌ Skipping Professional Inspection: Costly repairs later

❌ Inadequate Legal Review: Contract disputes

❌ NOC Delays: Not applying early enough

Market Mistakes:

❌ Overpaying: Not researching market rates

❌ Wrong Location: Poor resale/rental potential

❌ Ignoring Future Developments: Infrastructure impact

📱 ESSENTIAL APPS & DIGITAL TOOLS

Property Search Apps:

- Dubizzle - Largest property portal

- Property Finder - Advanced search filters

- Bayut - Market insights and analytics

- Just Property - Premium property focus

Financial Tools:

- Mortgage Calculator UAE - Payment calculations

- Currency Converter - Real-time exchange rates

- DLD Property Value - Market price verification

- Service Charge Calculator - Annual cost estimation

Government Apps:

- DubaiNow - Government services

- DEWA - Utility connections

- RTA Dubai - Transportation planning

- UAE Pass - Digital identity verification

🏛️ ESSENTIAL CONTACTS DIRECTORY

Government Offices:

- Dubai Land Department: +971-4-606-6661

- RERA: +971-600-540-000

- Dubai Municipality: +971-4-221-5555

- DEWA: +971-4-601-9999

Banks (Mortgage Services):

- Emirates NBD: +971-600-540-000

- ADCB: +971-2-311-4400

- Mashreq Bank: +971-4-217-4800

- CBD: +971-4-230-0400

Legal Services:

- Al Tamimi & Company: +971-4-364-1636

- Afridi & Angell: +971-4-330-3900

- Clyde & Co: +971-4-384-4000

MARKET FORECAST 2025-2026

Based on current trends and expert analysis:

Price Predictions:

- 2025: 15-18% growth expected

- 2026: 8-12% moderate growth

- Supply: 41,000 new units in 2025

Best Investment Opportunities:

- Off-plan properties in emerging areas

- Affordable housing under AED 1.5M

- Luxury penthouses in established areas

- Commercial properties in business districts

Areas to Watch:

- Dubai Creek Harbour - Major development completion

- Al Furjan - Infrastructure improvements

- Dubai South - Airport expansion impact

- Meydan - Entertainment district growth

Conclusion

Buying property in Dubai within 30 days is achievable with proper planning and professional guidance. The key to success lies in thorough preparation, understanding all legal requirements, and working with experienced professionals throughout the process.

🔄 FREQUENTLY ASKED QUESTIONS (2025)

Q: Can I get a mortgage as a non-resident?

Yes, several UAE banks offer mortgages to non-residents with minimum 30% down payment and higher income requirements.

Q: What's the minimum investment for Golden Visa?

AED 2 million for 10-year Golden Visa, or AED 750,000 for 2-year residence visa.

Q: Are there any restrictions on selling my property?

No restrictions. You can sell immediately after purchase, but consider holding for at least 2 years for optimal returns.

Q: Can I rent out my property immediately?

Yes, you can rent immediately. Dubai has strong rental laws protecting both landlords and tenants.

Q: What happens if the developer delays completion?

UAE law provides protection for off-plan buyers, including compensation for delays and right to cancel for significant delays.

.jpeg)